tax refund calculator ontario 2022

Formula for reverse calculating HST in Ontario Amount with sales tax 1 HST rate100 Amount without sales tax Amount without sales tax x HST rate100 Amount of HST in Ontario Example 100 1 13100 8850 88495575 88495575 x 13100 1150. 26 on the next 53404 of taxable income on the portion of taxable income over 97069 up to 150473 plus 29 on the next 63895 of taxable income on the portion of taxable income over 150473 up to 214368 plus 33of taxable income over 214368 Visit the CRA link for other provincial tax rates.

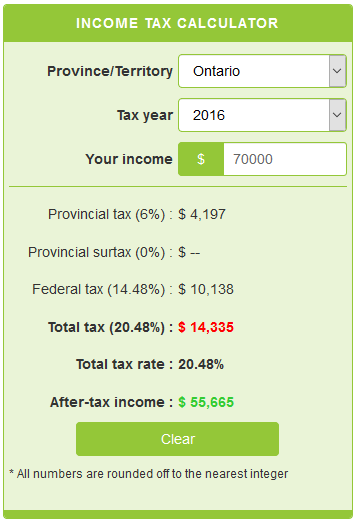

2019 Income Tax Calculator On Sale 59 Off Www Ingeniovirtual Com

The second tax bracket at 915 is increasing to an upper range of 90287 from the previous 89482.

. 2022 Income Tax in Ontario is calculated separately for Federal tax commitments and Ontario Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location. Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time. Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000.

The Ontario land transfer tax for a home purchased for 500000 in Ottawa is 6475. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. If youve already paid more than what you will owe in taxes youll likely receive a refund.

Youll fill out basic personal and family information to determine your filing status and claim any dependents. File your tax return today Your maximum refund is guaranteed. Youll get a rough estimate of how much youll get back or what youll owe.

Well calculate the difference on what you owe and what youve paid. The parent will receive no tax refund. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022.

Our tax refund calculator will do the work for you. Taxable Income Calculate These calculations do not include non-refundable tax credits other than the basic personal tax credit. The calculation will start on the latest of the following three dates.

The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator. That means that your net pay will be 37957 per year or 3163 per month. Meet with a Tax Expert to discuss and file your return in person.

See your tax refund estimate. However the child will only receive 50 of this amount or 2000. 2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and provincial factors.

The other sections will calculate your taxable income and find credits and deductions you can claim on your return. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. That means that your net pay will be 37957 per year or 3163 per month.

Brush up on the basics. Get started Employment income Self-employment income RRSP deduction. Is my income taxable.

The calculator reflects known rates as of January 15 2022. Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax calculator to review NIS payments and income tax. If your tax situation changes you can always come back to the calculator again.

The CRA will pay you compound daily interest on your tax refund for 2021. 2022 CWB amounts are based on 2021 amounts indexed for inflation. The amount of taxable income that applies to the first tax bracket at 505 is increasing from 44740 to 45142.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables. You have to give a reasonable estimate.

As you answer the questions you will see that the information you enter. 8 rows If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. Most types of income are taxable.

Use our simple 2021 income tax calculator for an idea of what your return will look like this year. The Canada Annual Tax Calculator is updated for the 202223 tax year. This marginal tax rate means that your immediate additional income will be taxed at this rate.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. The total Ontario land transfer tax would be 6475 - 2000 4475. For 2021 the basic personal amount is increasing to 10880.

Answer the simple questions the calculator asks. Have a refund of 2 or less Interest on your refund. Reflects known rates as of January 15 2022.

Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15. Free Income Tax Calculator - Estimate Your Taxes - SmartAsset Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculatorEnter your income and location to estimate your tax burdenMenu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading. Assumes RRSP contribution amount is fully deductible.

Your average tax rate is 270 and your marginal tax rate is 353. 25 Sales Tax Rate for Food and. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory.

TurboTax Free customers are entitled to a payment of 999. 2022 RRSP savings calculator. Step 1 Run Your Numbers in the Tax Refund CalculatorEstimator.

The maximum tax refund is 4000 as the property is over 368000. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. File your taxes the way you want.

Your average tax rate is 270 and your marginal tax rate is 353. The 2022 Ontario Tax return is completed as one single calculation. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Non-Refundable Credits and Taxes. No change on the HST rate as been made for Ontario in 2022. Calculate the tax savings your RRSP contribution generates in each province and territory.

You can also create your new 2022 W-4 at the end of the tool on the tax return result page Start the TAXstimator Then select your IRS Tax Return Filing Status. The Ontario Basic Personal Amount was 10783 in 2020. May 31 2022 the 31st day after you file your return the day after you overpaid your taxes For more information see Prescribed interest rates.

You dont have to be 100 exact. If you paid less you may owe a balance.

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

How To Calculate Foreigner S Income Tax In China China Admissions

Income Tax Calculator For Self Employed Shop 51 Off Www Ingeniovirtual Com

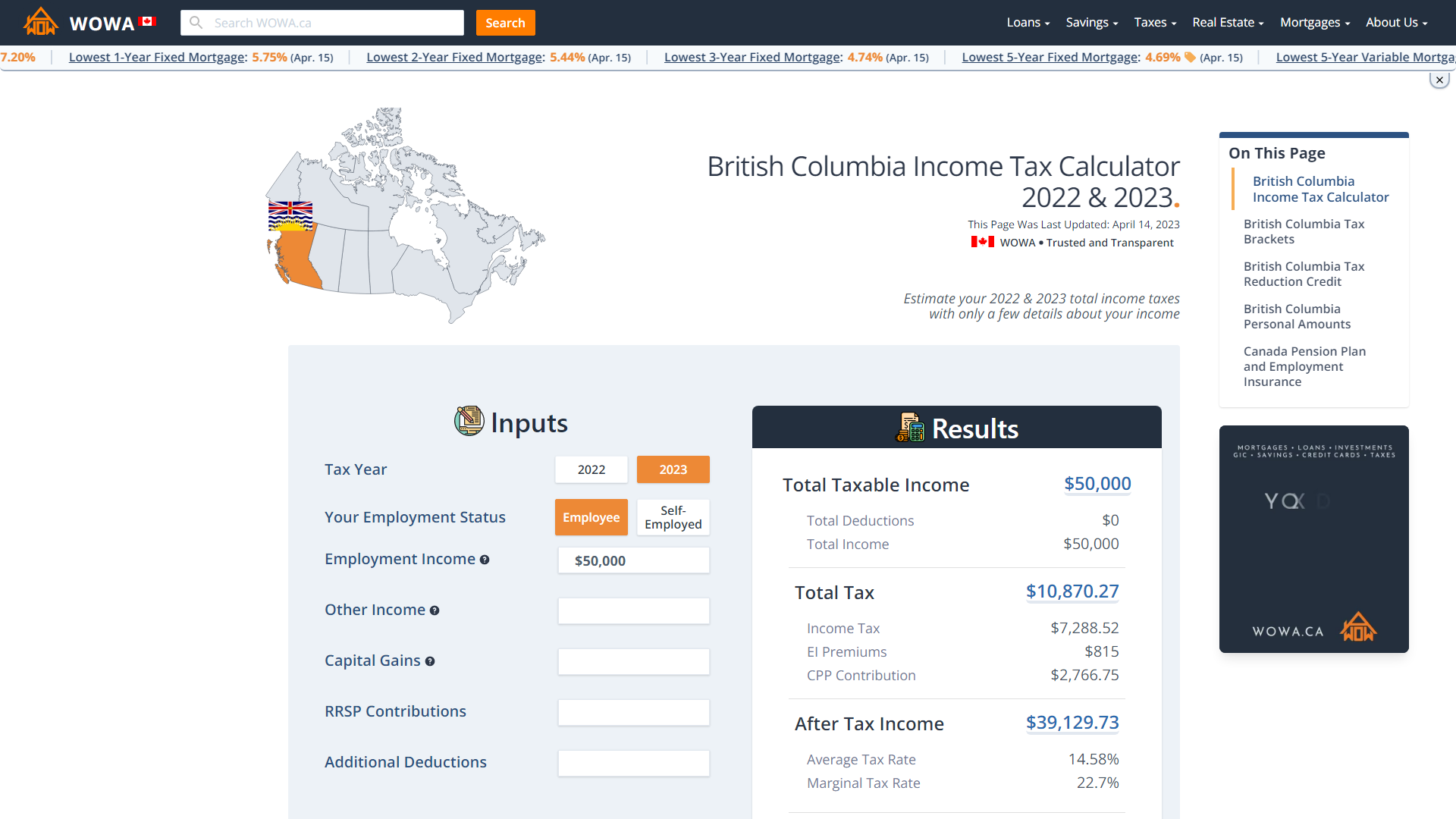

2021 2022 Income Tax Calculator Canada Wowa Ca

Income Tax Calculator For Self Employed On Sale 53 Off Www Ingeniovirtual Com

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

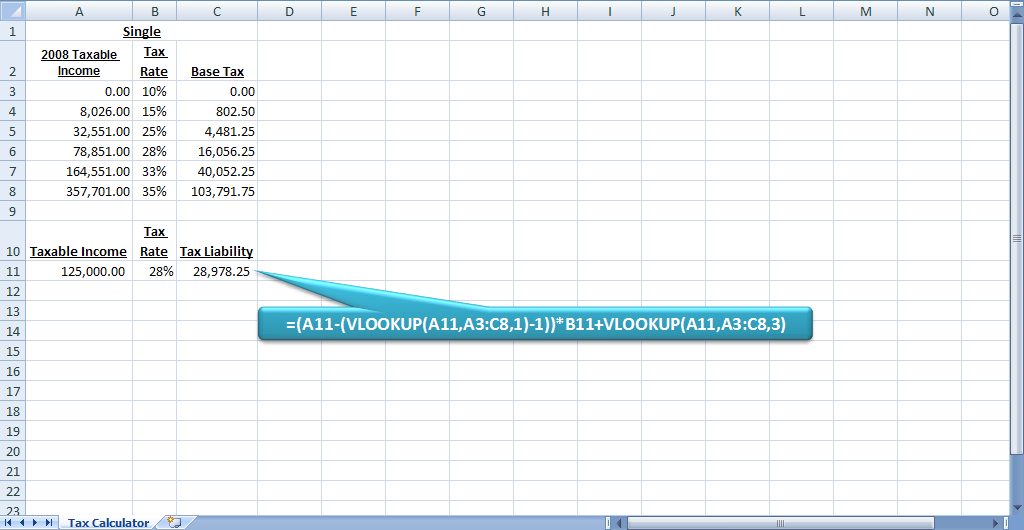

Excel Formula Income Tax Bracket Calculation Exceljet

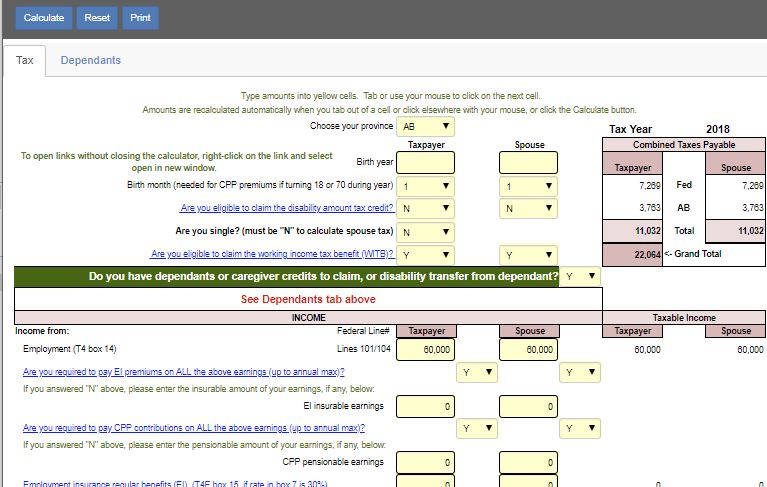

Taxtips Ca 2018 Canadian Income Tax And Rrsp Savings Calculator

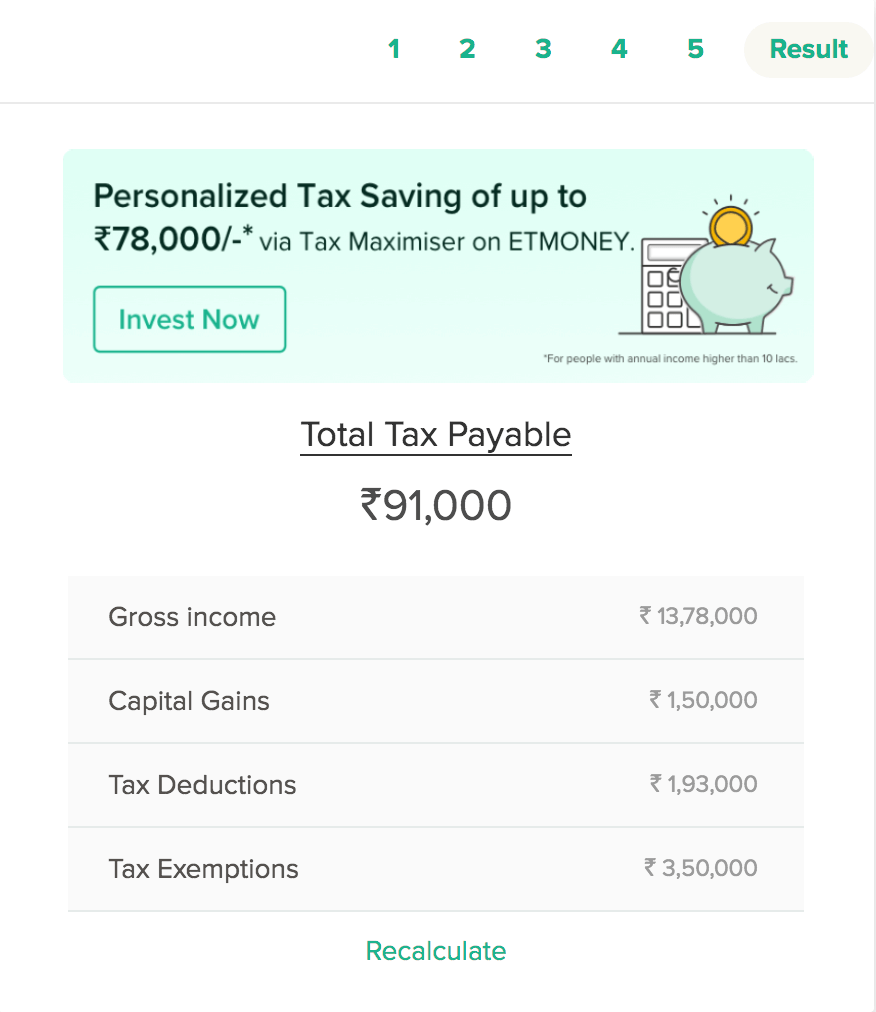

Online Income Tax Calculator Flash Sales 53 Off Www Ingeniovirtual Com

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Finnish Vat Calculator Vatcalculator Eu

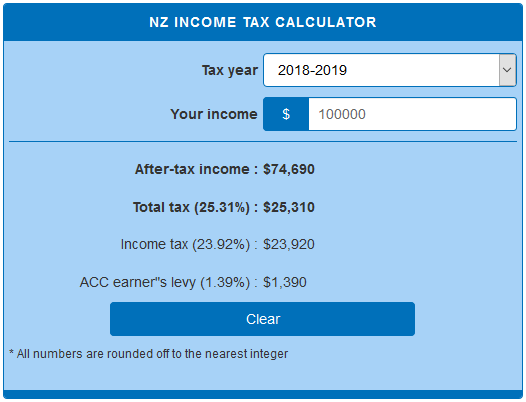

New Zealand Income Tax Calculator Calculatorsworld Com

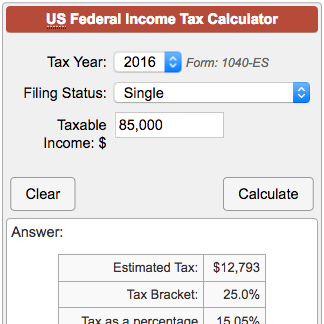

Federal Tax Calculator Hot Sale 53 Off Www Turkishconnextions Co Uk

Income Tax Estimator On Sale 55 Off Www Ingeniovirtual Com

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits